[ad_1]

A growing number of ASX 200 CEOs are being forced out of office by ESG pressure. But such moves may come with financial resistance, warns a new Kearney report.

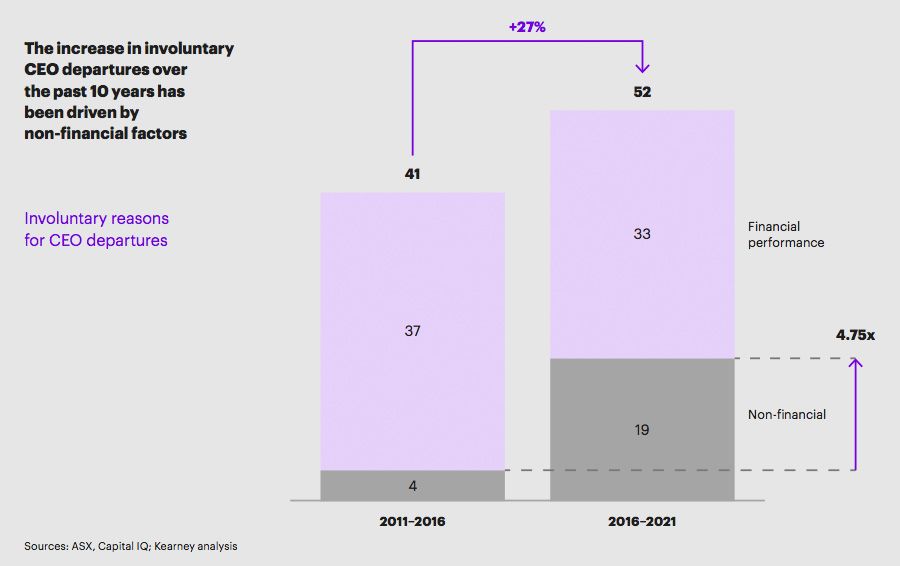

The ASX 200 saw 41 forced CEO departures between 2011 and 2016 – 37 of which were linked to their company’s poor financial performance. Over the past five years, suboptimal financial conditions have forced 33 CEOs to leave, while the number of departures for non-financial reasons has quadrupled to 19.

Kearney explored the reasons for this shift. “There is no evidence that today’s CEOs are significantly lacking in ability and character. But they are held to new and higher standards,” explained Kearney’s Sydney-based partner Alasdair Johnston.

At the forefront is the growing focus – across business, government and society – on environmental, social and corporate governance (ESG) factors. In this broad foreground are a number of contemporary drivers such as diversity, equality, inclusion, freedom from abuse and harassment, social responsibility and sustainability – among others.

Some CEOs directly violate these principles, and as a result, more and more are opening the door to such considerations.

This means that even less direct involvement in wrongdoing is now all it takes to open the door. “CEOs are increasingly vulnerable to being fired for turning a blind eye to a toxic corporate culture or failing to prevent socially irresponsible or unethical employee behavior,” Johnston noted.

A case in point is the ousting of Francesco De Ferrari in April 2021 – chief executive of ASX-listed wealth management giant AMP – as the company dealt with allegations of sexual abuse against a senior leader. His departure was preceded and followed by a steady decline in AMP’s share price – a common outcome of such a scenario, according to researchers.

Financial impact

Voluntary departures typically cause the stock price to spike, as natural turnover in management signals healthy operations. Forced exits for financial reasons also cause monetary support – fueled by optimism about the new approach.

“In contrast, a company’s share price tends to suffer as a result of an involuntary, non-financial CEO exit, underperforming the ASX 200 by almost 8 percentage points on average one year after the announcement,” partner Kearney explained based in Sydney. Gerd Schenkel.

“When a CEO is ousted for ESG reasons, investors may worry that there are deeper structural flaws in the organization that may take longer to fix than purely financial issues,” he added. That’s a message the company wants to avoid at all costs, but it’s trying to do it. According to the researchers, companies need a paradigm shift.

ESG performance must be aligned with all other corporate goals—including robust risk management frameworks, regular feedback cycles with consumers and shareholders, and a personal commitment by leaders to lead by example in ESG compliance. A strong set of fundamental principles is needed and even the smallest transgressions should be addressed to promote stable and responsible business.

[ad_2]