[ad_1]

Australia’s major banks have seen profits fall by more than 40% in the first half of this year compared to the same period last year. This follows from an analysis by KPMG, which attributes this drop, among other things, to the effects of Covid-19.

Commonwealth Bank of Australia (CBA), Westpac Banking Corporation (Westpac), Australia & New Zealand Banking Group (ANZ) and National Australia Bank (NAB) have reported a cumulative cash profit after tax of just over $8 billion for the first half of this year , which represents a year-on-year decrease of almost 43%.

Meanwhile, costs rose by nearly 15% over the same period. Of the big banks’ $21 billion in operating expenses this year, special items accounted for just over $2 billion, leaving operating expenses at just over $19 billion. This represents an increase of $560 million over last year.

As a result, the cost-to-income ratio rose across all four banks, with the average up nearly 880 basis points to just under 55%. According to KPMG, investments in technology and jumps in personnel costs are the primary factors responsible for the increase, and both cost bases have been strengthened by the Covid-19 crisis.

“Naturally, the initial focus of large companies was to protect their employees and customers. This has required an unprecedented mobilization of resources to service customers (and an increase in Covid-19 inquiries) over the phone and digitally, while implementing split teams and remote work agreements and resolving (offshore) disruptions with their service providers. This initial response required a huge coordination effort on the part of major companies,” the KPMG report wrote.

In addition to this sudden and unforeseen surge, spending in the tech space has revolved around regulatory technology (RegTech) as banks struggle to stay within compliance after many slapped themselves on the wrist in recent years. Cloud technology is also constantly evolving among banks.

On the staffing side, the cost was moving staff around to meet temporary demands during the crisis, as well as overall wage increases. KPMG says the number of full-time employees has remained largely constant at all four banks since the first half of last year. In the meantime, other temporary workers were called in.

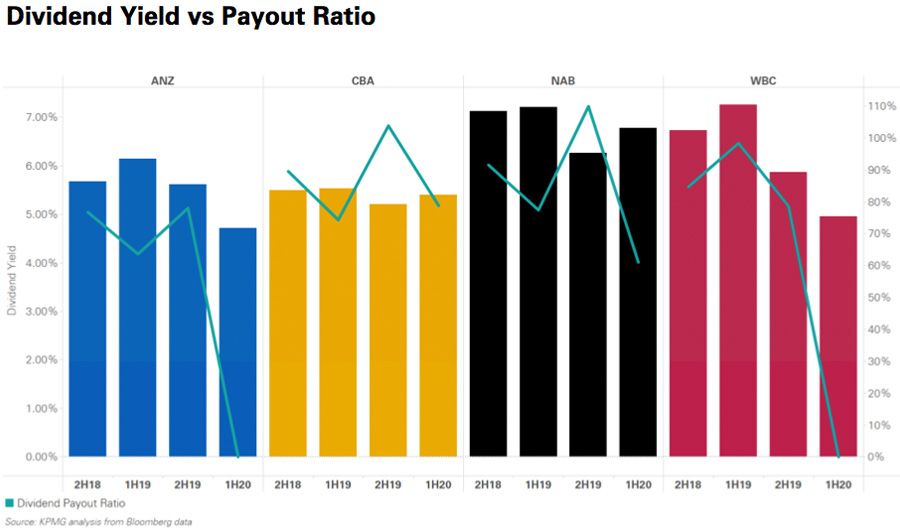

The financial strain from these factors is evident in dividends and payouts across the big banks. Both ANZ and Westpac suspended their interim dividend in light of the crisis, while NAB cut its dividend by 64% to 30 cents a share. At the same time, the average return on equity (ROE) reached an average of 6.4% in the first half of this year, which is the first time in the medium term that the average return on investments has fallen to single-digit values.

Speaking to the Australian Financial Review, KPMG Strategy Australia partner and co-author of KPMG’s Major Banks analysis Hessel Verbeek predicted those single-digit ROEs would remain. According to him, the drop in profits – although accentuated by Covid-19 – is not explicitly a consequence of the crisis.

A large cost base, combined with regulatory upheaval and increasing competition in mortgages and loans, has threatened the profitability of Australia’s major banks for a number of years. Verbeek said existing banks had already been forced out while “Covid-19 has drastically accelerated the pace”.

For Verbeek, the way forward for the big banks is to reduce their substantial cost base. While banks around the world have been increasing their digital presence and reducing their physical footprint in recent years, Australia’s big banks have been slow to do so. Some were laying off employees, but few focused on reducing their brick-and-mortar presence. Since 2015, Verbeek points out, Australian banks have closed a total of 900 branches, compared to 3,500 closures in the UK over the same period.

Product offering prioritization and infrastructure outsourcing are other potential areas of cost savings. At a broader level, Verbeek suggests a “zero-based budgeting” approach, where funds are allocated on a program-by-program basis depending on value and importance.

[ad_2]