[ad_1]

Banks around the world are lagging behind in their readiness for upcoming ESG regulatory reporting, according to a new report from Avanade and the European Financial Management Association.

Today, consumers are increasingly holding organizations, institutions and industries accountable for better sustainability and climate risk management practices.

The financial services industry is no different – banks are under pressure to go beyond including environmental, social and governance (ESG) goals in their mission statements. They are now expected to demonstrate transparency, create a greener portfolio and develop a sustainability plan that will lead to a lower carbon footprint.

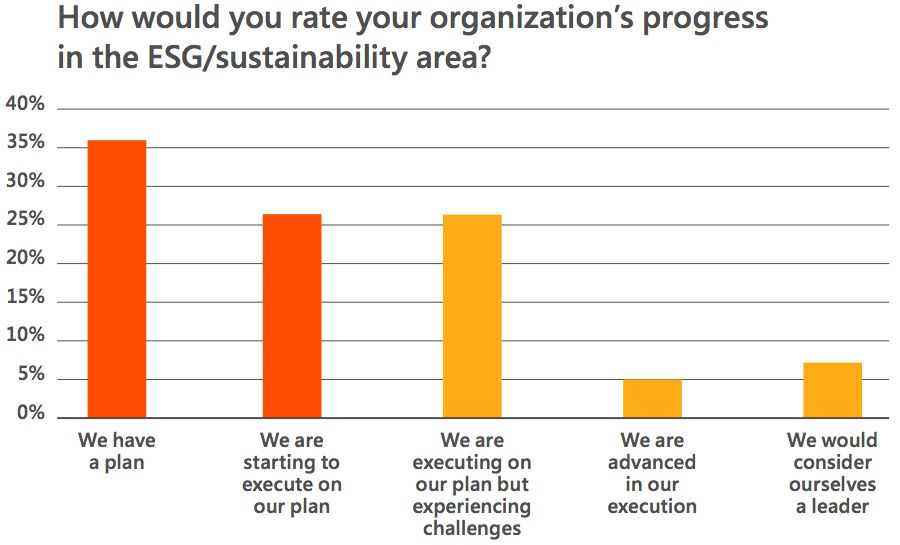

Globally, regulators are moving away from voluntary codes of conduct towards mandatory requirements, creating a growing sense of urgency for banks to prepare sooner rather than later. However, while many financial institutions already have their ESG targets firmly set, the reality is that banks are not on track to achieve these targets.

A report by Avanade and the European Financial Management Association (EFMA) found that – although the majority (70%) of banks consider their ESG work to have a positive impact on their market reputation and credibility, only half of these banks (53%) will be ready for regulatory reporting in the next six months.

In addition, more than half of banks (57%) admit they will not achieve net zero carbon operations by 2025, and only 1 in 4 now have a climate risk model in place.

Saurabh Verma, head of financial services at Avanade in Australia, said: “The biggest challenge for banks in Australia is to keep up with the pace of regulatory change while supporting their customers in the opportunities presented by ESG. A fair investment of time, energy and capacity is required.”

As banks increasingly respond to stakeholder demands for sustainability, successfully meeting them will mean banks can expect to redefine and strengthen their character and reputation for many years to come.

The research also suggests that the biggest challenge for banks in terms of climate risk analysis is data integration with almost a third of banks (32%) struggling with insufficient integration of climate risk data with their risk management framework.

Verma added: “The opportunity is to look at innovative ways to address sustainability challenges more effectively – such as using technology solutions, external and internal data sources and partnerships to give banks the capabilities and insights they need to realize their ESG goals.”

The report suggests that banks should create a holistic plan for their sustainability ambitions to successfully move from strategy to execution. Key elements of this plan include:

- Take a ‘Go Green’ approach across their product portfolio to reach younger demographics

- Create robust stress testing and scenario analysis for climate risks

- Show full transparency of operations

- Use technology to collect data more efficiently and generate better reporting, scenario planning and risk management.

- Be prepared to make tough decisions about where to stop investing altogether to show a clear agenda for transitioning to a low-carbon investment portfolio.

According to a Consultancy.uk report on the same Avanade and EFMA report, 70% of banks now see their ESG work having a positive impact on their market reputation and credibility and attractiveness to new talent, particularly millennials and the ESG-aware generation. FROM.

[ad_2]