[ad_1]

Covid-19 has thrown finance and accounting professionals into a frenzy, and few are equipped with the right tools to handle the pressure. The new BlackLine study presents the key challenges facing this segment.

BlackLine’s analysis is based on a survey conducted by independent research firm Censuswide of 1,300 C-suite executives and finance and accounting professionals at mid-sized and large companies worldwide. Approximately 150 of these business leaders are based in Australia.

Against the backdrop of the economic crisis, finance and accounting professionals seem burdened with the main challenge facing the business environment – providing an accurate picture of company performance without any precedent for pandemic response or forecasting for a post-pandemic world.

A third of finance and accounting professionals face more pressure than ever since the pandemic, while a similar person feels obliged to fulfill these duties without any other tools in hand. The focus is on the sheer scale of changes compared to last year.

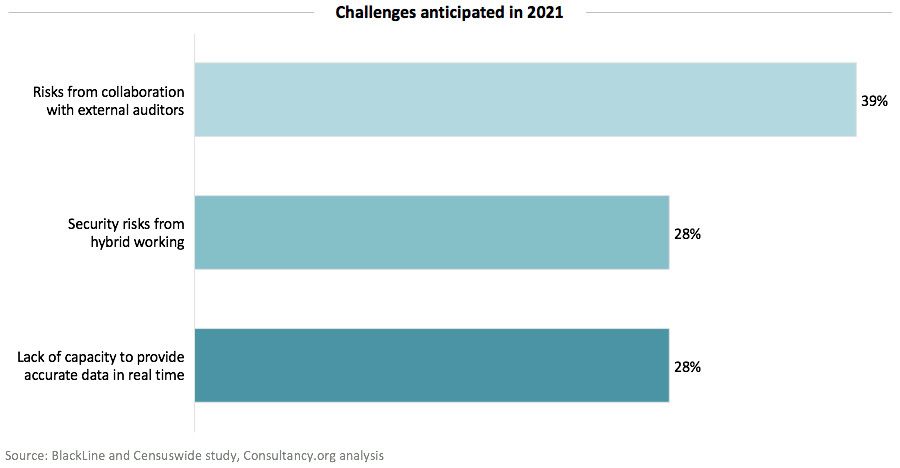

Take, for example, labor measures. In 2021, many companies are considering hybrid work models – a combination of virtual work and coming to the office. For financial professionals, working remotely means a direct increase in compliance and fraud risks, requiring a range of new governance mechanisms.

Then there is the risk of working with third parties who have their own compliance concerns. Probably the biggest challenge is the lack of adequate data options – a problem mentioned by almost 30% of respondents.

“At a time when strategic decisions must be made quickly—often to address unprecedented challenges—agility and access to data are critical,” explained Marc Huffman, CEO of BlackLine. Finance and accounting professionals fear that they simply cannot provide data with the speed and accuracy required in a crisis.

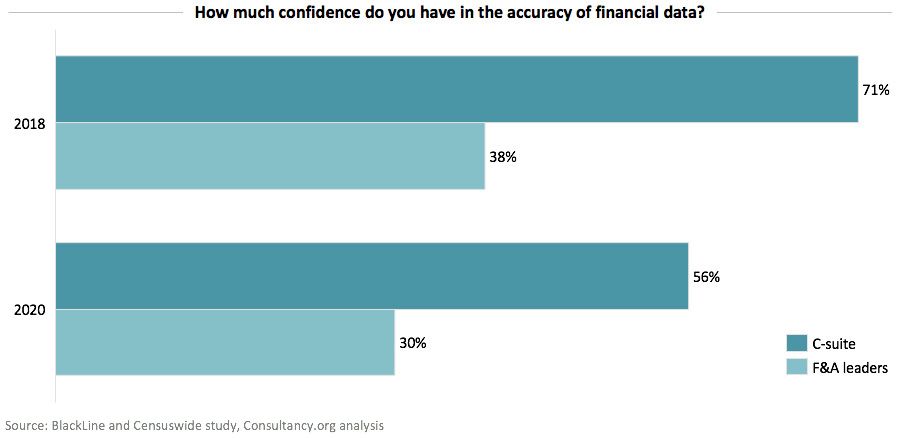

In reality, these professionals have little confidence in their own data, especially compared to other C-suite executives. BlackLine conducted a similar study in 2018 – where more than 70% of C-suite executives reported complete confidence in the accuracy of their financial data. For finance and accounting professionals, this figure was less than 40%.

Today, faith is significantly lower across the board. Some 56% of C-suite executives now trust their financial data, backed only by 30% of the finance and accounting team. The analysis includes input from leading figures from the Big Four accountancy and consultancy firms – who suggest this scenario is far from sustainable.

“Poor visibility into financial data represents an unnecessary level of risk for many large organizations,” explained Ralph Canter, Advisory Managing Director at KPMG. “Not only could this mean that strategic decisions are based on inaccurate numbers, but it could also result in non-compliance in an ever-expanding global business environment.”

Digital is the key

According to Tony Klimas, Global Performance Improvement Finance Leader at EY, the pandemic has exposed key gaps in finance and accounting practices around the world. At the same time, such fundamental upheaval also represents “an opportunity for executives to reevaluate the finance function.”

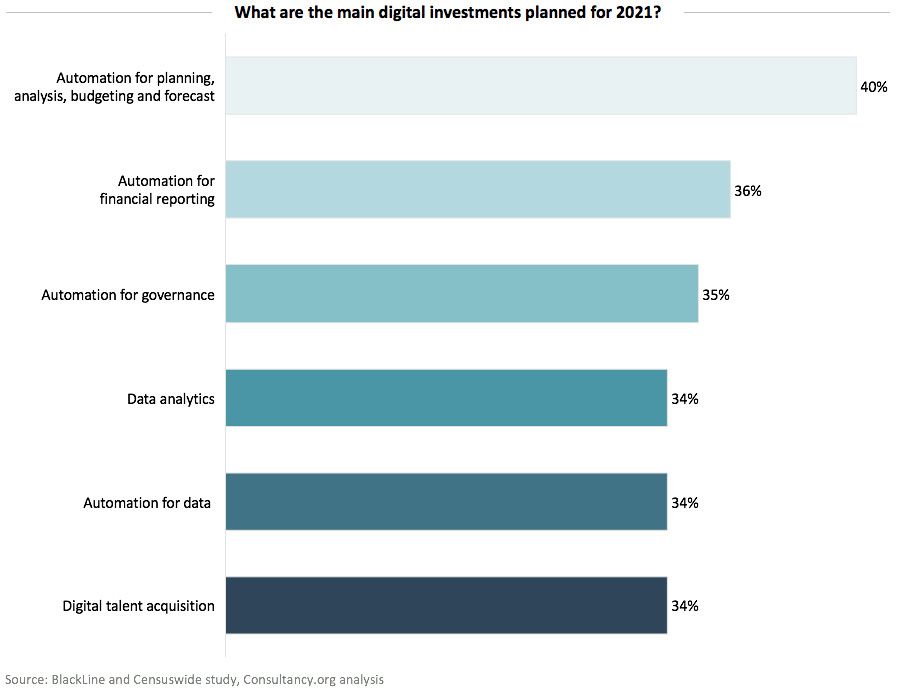

Technology is key here – a fact that most financial professionals are aware of. More than a third want their company to invest in data analytics capabilities this year to get better data. A notable proportion also put their faith in automation.

Whether it’s financial reporting, management, planning, analysis, budgeting or forecasting, 35% to 40% of professionals believe that automation plays a key role. Just over a third also recognize that having more talent with the right skills will relieve some pressure on the finance function and enable greater value-added output.

For Tom Toppen, CEO of Deloitte, it’s the right way to go. “Just as companies have recognized that technology is essential to support virtual meetings and conferences, they should also recognize the value of implementing technology that allows these teams to seamlessly access systems remotely, reduce manual processes, and ultimately improve visibility and accuracy of financial data. .”

[ad_2]