[ad_1]

According to a joint report by the Economist Intelligence Unit and Appian, executives and decision-makers in the financial services industry believe that the cloud will be the most important technology for the success of their organizations in the next 12 months. Luke Thomas, VP APAC at Appian, walks through the report’s key findings.

During Covid-19, the cloud has proven that it can help financial services organizations scale operations quickly and efficiently. Collaboration tools that were once used occasionally are now used almost continuously.

Another clear example of cloud-based digital transformation in financial services during the pandemic is the shift to online customer service models. In a recent report, EY refers to the “incredible transformation” during the lockdown, where major banks have moved almost all of their interactions with customers to digital channels such as websites and mobile apps.

Accelerated use of digital channels

Neil Morgan, chief operating officer of Australian insurance giant IAG, has witnessed a similar transition at his company. At the start of the pandemic, IAG saw app usage in NRMA Insurance – one of the firm’s core brands – increase by more than 50%. Morgan says the company continues to see “really high levels” of app usage across recovery activity, new business registrations and claims.

“Covid-19 has definitely accelerated the appetite of customers to use digital channels, which they may not have done historically. The question for us is just how much we can leverage this change in behavior,” says Morgan.

European bank Capital One witnessed a similar transition. The bank’s mobile app is its predominant customer service channel in the UK. However, some customers still prefer to talk to an assistant over the phone – and this was not always possible at the beginning of the pandemic, when call center operations were affected by the transition to working from home.

Joe Soule, Chief Technology Officer of Capital One Europe, says the bank’s long-term investment in digital automation has meant the bank has been able to continue to serve its customers in a variety of ways online. Instead of going directly to the bank’s app, many customers who traditionally used the phone have started using the web channel as the first step to digitally interact with the company.

Digital transformation from the pandemic

Financial services organizations should use these operational successes to make the case for further digital transformation. Based on their experience with the pandemic, more than four in five (81%) financial services managers believe their organization needs to improve their IT infrastructure and applications to better adapt to external changes.

Research also provides evidence of increased demand for digital automation. Nearly three-quarters (71%) of IT decision-makers in financial services report that growth in technology project requirements is outpacing IT budget growth, higher than the global average of 64%.

Financial services IT teams will need all the help they can get to handle this ongoing development workload. One potential enabler is robotic process automation (RPA), which can be used to reduce the burden of repetitive tasks in a business, including software development processes.

Application development is a resource-intensive activity, both in terms of people and costs. Thus, cloud and automation can help financial services businesses standardize activities and deliver products to market safely, effectively and efficiently.

Further reading: What lies ahead for cloud adoption in financial services.

31% of financial services executives see automation as one of the most important areas of focus in the next 12 months. Respondents expect cybersecurity to be at the center of automation efforts (43% said it would be a top three goal). Innovation and research and development (35%) and customer-oriented processes (34%) are considered other priority areas.

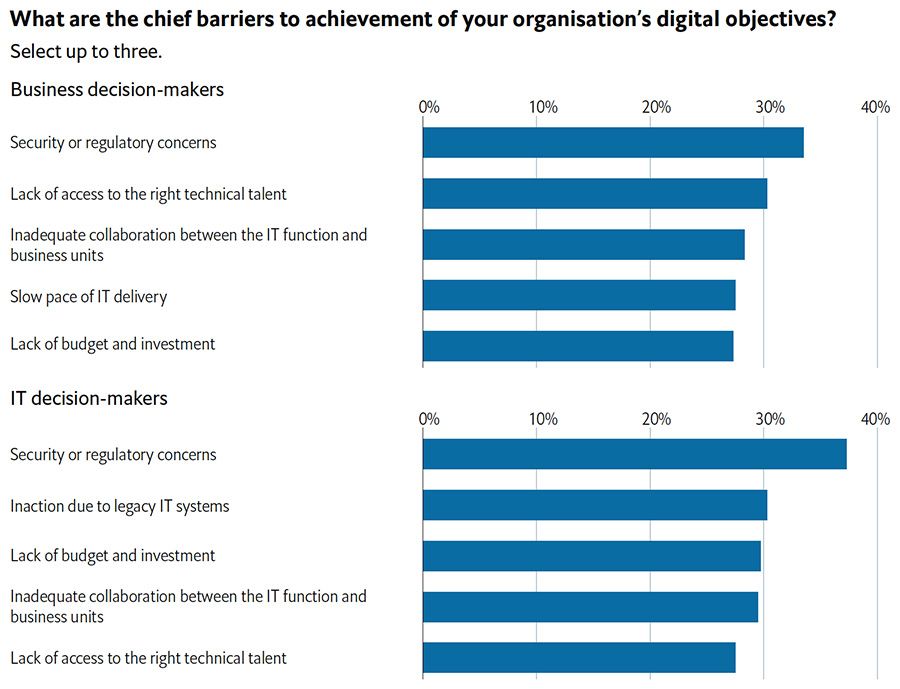

About two-thirds (66%) of financial services IT decision-makers say RPA efforts often fail. In addition to gaining access to better data, 42% of respondents believe that closer collaboration between IT and business units will help their organization achieve its automation goals.

Breaking down forces to accelerate automation

The research highlights that a strong bond between business and IT is critical to overcoming IT backlogs and achieving digital transformation goals. IT needs to work with business units to identify how technology solutions can solve business challenges.

Agile management techniques play a key role in this partnership approach. Originating in software development, agile management—which uses techniques like iteration, stand-up, and retrospectives—encourages decentralized decision-making across collaborative teams.

The most unified and complete views of automation across financial services organizations deliver the greatest benefits. That’s because unification seamlessly delivers benefits for customer experience, employee satisfaction, and the future of the organization—as well as supporting risk management, compliance and change, and business strategy.

Solutions like low code can help financial services businesses break down silos so that IT and business units can work together effectively. Low-code is designed to unify all financial services systems, databases, channels and customer information, as well as connect people, processes and data through automation: robotic process automation, artificial intelligence (AI), workflows and more.

[ad_2]