[ad_1]

While a significant proportion of Australia’s business landscape appears to have become familiar with cloud technology, few have moved beyond this ‘gateway’ technology to more advanced technologies such as the Internet of Things (IoT), artificial intelligence (AI) and robotic process automation.

In a new KPMG report, the firm’s researchers question the growing complacency surrounding digitization and the concept that most businesses are already familiar with the concept of the fourth industrial revolution, also known as Industry 4.0.

Since industrialization in the 18th century, humanity has experienced four technological revolutions. Each had a profound impact on society, started by steam enabling mechanical production, followed by electricity enabling mass production, and the third technology-driven industrial revolution, the emergence of computers and digital systems.

A term imported from the United States and Germany, Industry 4.0 refers to the advent of technology such as the cloud, internet of things, artificial intelligence, blockchain, 3D printing, robotics, virtual reality and many others.

However, KPMG emphasizes that the term is not simply a label for these technologies, but refers more broadly to a range of structural and operational changes across businesses. “Industry 4.0 represents a fundamental change in the way we live, work and relate to each other,” the company says in its report.

A fundamental change

“Business disruption is the most obvious consequence of Industry 4.0, while others include developments in innovation and productivity, changes in security and conflict considerations, and considerations of ethics and identity.”

The report also points out that the high costs required to embrace the Industry 4.0 space could accentuate the existing wealth gap around the world, while threatening to initially worsen unemployment levels. Required skills workplaces are evolving and economies will need time to adjust to these changes.

Industry 4.0 also challenges current global regulatory frameworks and introduces technological capabilities into the monitoring and compliance process. Finally, Industry 4.0 encourages collaboration across disciplines and technology spheres, creating transformative hybrids and mergers.

Maturity

A survey of Australian entrepreneurs found that less than half have a good understanding of Industry 4.0 and its implications. Just under 10%, meanwhile, had never even heard of the term before, showing how far the technology still has to go.

This mixed bag of results is reflected in the maturity of organizations when it comes to adopting Industry 4.0 technologies. KPMG has proposed a scale between 1 and 5 to rate the maturity of an organization, with a score of 1 indicating that the technology has not been adopted and a strategy for its adoption has not yet been devised. A score of 5, meanwhile, means the organization is on the cusp of integrating with a particular technology, with plans to implement it in the short, medium and long term.

For example, the average score for cloud computing businesses was just under 4, but then IoT came in second with a score of just 2.7, highlighting the wide gap between cloud and the rest.

Australia’s cloud market is growing rapidlywith Boston Consulting Group (BCG) estimates the market will be worth $11 billion by 2023. However, KPMG describes cloud computing as a “gateway”, often used as a means of reducing costs and improving efficiency and security, which can then facilitate further investment in other technologies.

Artificial intelligence, robotic process automation and robotics round out the top five, with nanotechnology enjoying the lowest level of maturity of the Industry 4.0 technologies surveyed.

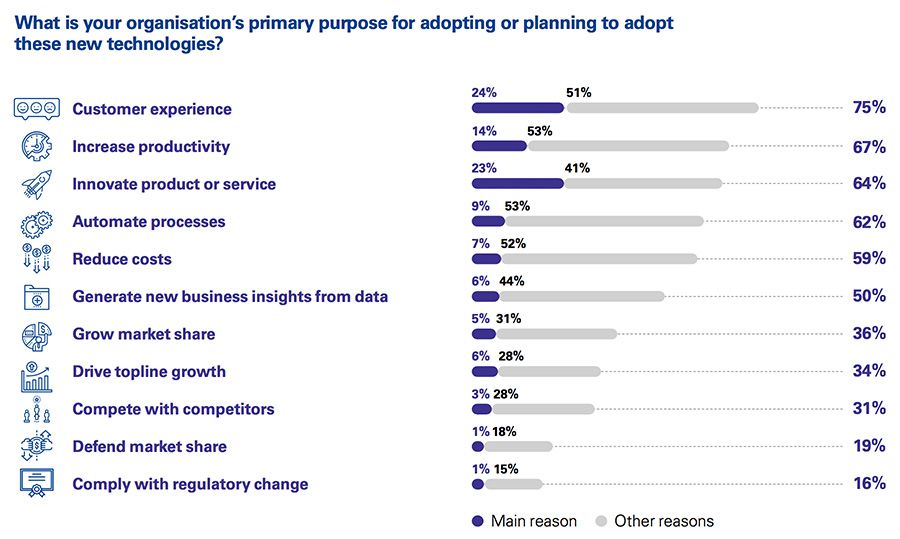

Organizations seem to have an idea of where they plan to deploy these technologies, with most choosing to use them to improve the customer experience. Increased productivity, product and service innovation, and cost reduction followed as motivations for adoption.

Australia risks falling behind

According to researchers, the fourth industrial revolution represents a “trillion-dollar opportunity” for the Australian market. For example, the combination of IoT and artificial intelligence has the potential to dramatically accelerate the benefits of digital transformation and data exchange for consumer, enterprise, industrial and government market segments.

This means that while awareness of the underlying technologies is high among Australian managers, their readiness is low. In contrast, economic powerhouses China and the USA have a significant strategic focus on investments in these technologies. “Australia risks being left behind over the next decade if it does not address issues of awareness and intent to invest,” the authors conclude.

[ad_2]