[ad_1]

Australia’s venture capital scene has had another record year, with total spending on promising and fast-growing start-ups surpassing the $2 billion mark for the first time.

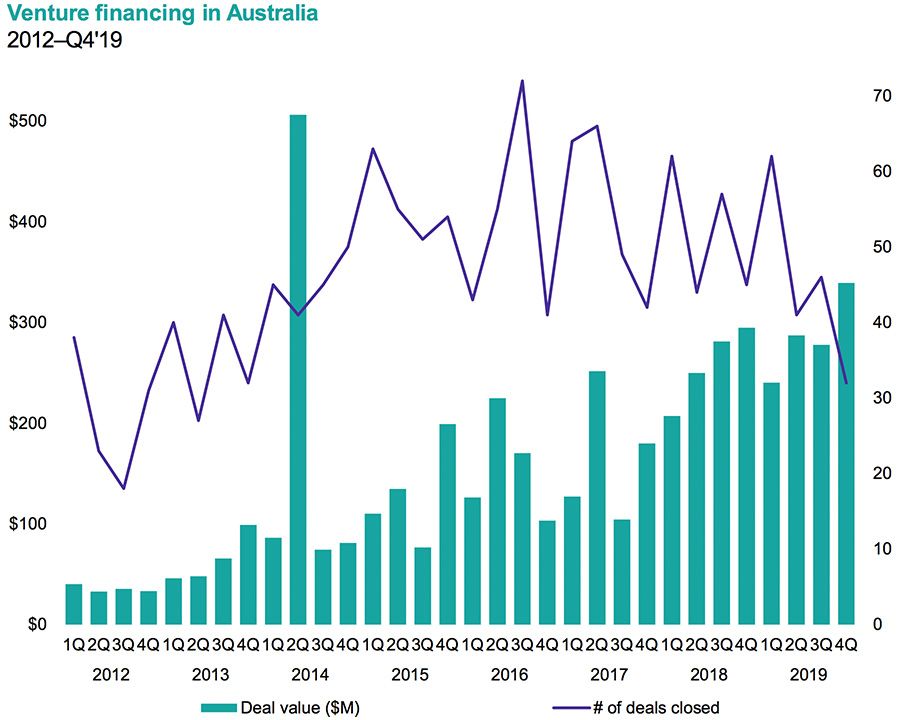

Funding for early and late stage startups grew by around $600 million over the past twelve months from $1.6 billion in 2018 to $2.2 billion at the end of 2019, according to KPMG analysis.

The development is contrary to the global trend, where there has been a significant decrease in total spending on risk capital. In 2018, start-ups received $456 billion in investment, and a year later, that figure dropped to $390 billion. Asia and the Pacific saw the biggest drop, down about $80 billion to $110 billion at the end of last year.

“Australia bucked regional trends, leaving Asia as the primary weak spot in the global venture capital market,” said KPMG’s Amanda Price. in Australia.

Despite growth in store volume, the number of stores in Australia continues to decline. The fourth quarter of 2019 saw the lowest quarterly number of deals (32) in six years, but also one of the highest total quarterly investments ($512 million) in that period.

Price: “We’re seeing higher deal volumes across the board, which is a strong sign of the quality of venture-backed startups coming out of the local ecosystem.”

A $128 million investment in IT company Canva was the biggest deal of the year, followed by investments in Secure Code Warrior, Athena Home Loans, Harrison.ai and V2 Food. In stark comparison, two startups in China (Tenglong and Beike) and one in India (Paytm) have raised more than $1 billion in funding as investors such as corporations, fund managers and family offices sit on piles of cash in an environment with low interest.

Commenting on the outlook for 2020, the KPMG expert said the domestic venture capital market is expected to remain relatively stable, with areas such as artificial intelligence, biotechnology and fintech remaining very hot.

[ad_2]