Australia’s royal commission into banking misconduct may have already wiped billions from the sector’s overall market value, but banks still represent Australia’s most valuable branded sector. BrandZ’s “Top 40 Most Valuable Australian Brands” 2018.

Australia’s Big Four banks have been named as four of the five most valuable brands in the country. Commonwealth Bank of Australia, ANZ, Westpac and NAB were all present at the top of the rankings with a total combined value of $47 billion. The banking sector in general was the most represented industry to appear in the rankings, with a total of nine items accounting for more than half the value of the entire 40 brands mentioned.

The BrandZ 2018 ‘Top 40 Most Valuable Australian Brands’ report was led by WPPAUNZ and Kantar Millward Brown – Kantar Group’s creative, digital strategy, marketing and communications in Australia and New Zealand. The most valuable Australian brand according to BrandZ’s first annual Australia-specific ranking is the Commonwealth Bank of Australia, with a total brand value of $16.4 billion. After CBA in second place is ANZ with a brand value of $11.9 billion.

Telstra also appeared in the top 5, followed by the other big four banks, Westpac and NAB, at $9.3 billion and $8.7 billion respectively. St. George was the only other bank to appear in the rest of the top 10, which was otherwise populated by Woolworths, Coles, Optus & Origin.

The company’s brand valuation and equity platform, BrandZ, compiled the results using a valuation methodology that includes; corporate profits and revenues, market and logistics factors (price, availability and distribution) and consumer association research (brand meaningfulness, perceived distinctiveness and brand salience). Each brand must also originate in Australia and either be listed on a credible stock exchange or have their financials available in the public domain.

Retailers had the highest representation in terms of numbers in the index, with 11 of the top 40 belonging to this sector. Alcohol companies, telecommunications providers and energy companies had between three and five entries, and airlines, fast food and food and dairy appeared on the list once or twice. Banking alone had a total of nine entries, including the above entities and Suncorp, Bankwest, Bank of Queensland and Bendigo Bank.

The banking sector as a whole has been supporting the country’s economic growth since the mining boom subsided. “Australia’s economy has been growing over the past two decades with low unemployment, limited inflation, strong government securities, low debt, and the banking sector has been its mainstay,” the report said.

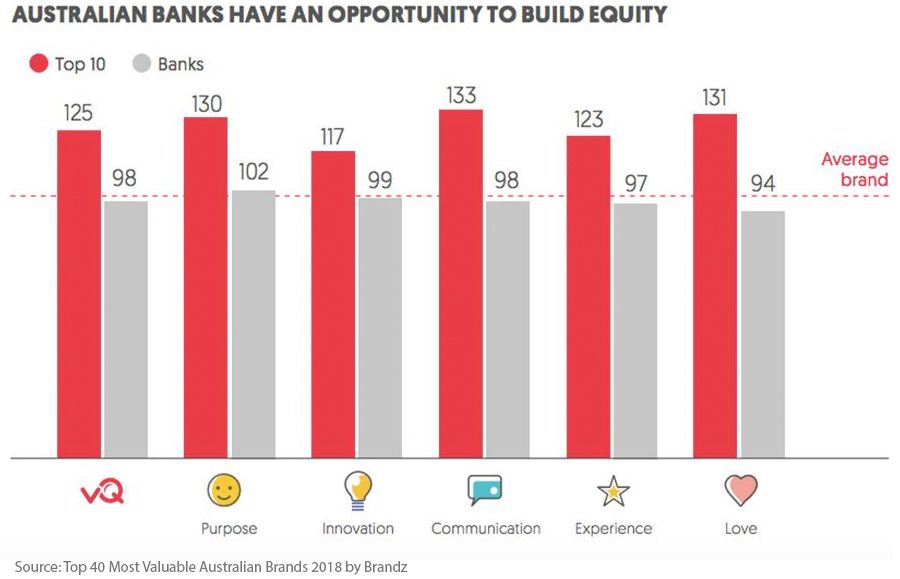

“However, most bank brands are perceived as dishonest and consumers show a general lack of trust, suggesting that branding opportunities are critical to long-term brand health. This will be particularly important in a post-Royal Commission environment and in a world of mega-corporate institutions that are growing through M&A activity.”

The Australian Royal Commission has damaged the banking sector, which basically stems from the general public’s lack of trust in the financial industry. The Australian government’s decision to investigate wrongdoing in the banking, superannuation and financial services industry resulted in $8.9 billion in losses, according to BrandZ.

A survey by a consulting firm shows that a brand that is perceived as dishonest will stagnate in the growth of brand value. “The lesson here is that at this point, Australian banking brands need to start anew and use branding as a way to restore trust and build relationships,” the report said.

To regain the trust of the general public, brands in the banking sector need to start reconnecting with their communities, the firm suggests. “Optimistic brand messaging, warm and welcoming employees, corporate investment in social support programs, environmental responsibility and simple, personalized digital experiences are all important components of building trust.”

BrandZ further suggests that “emphasis needs to be placed on communicating how these brands meet consumer needs, improve brand equity, and strengthen any remaining weaknesses (ie, trust and dishonesty). The opportunity to build trust and reduce perceptions of dishonesty should not be missed and getting in front of the news will send the right signals to shareholders, depositors and to a large extent the rest of the Australian economy.”