[ad_1]

PwC has conducted a survey of directors of several Australian Stock Exchange (ASX)-listed companies, revealing that the country’s boards are increasingly out of touch with what the public expects of them. Less than 40% of these companies appear to have taken action to remedy the situation.

The Big Four accountancy and advisory firm surveyed more than 100 directors across ASX 300 boards to gauge their views on relevant management. Respondents came from a range of Australia’s most prominent sectors, including energy and resources, consumer markets, financial services and real estate.

70% of these directors said the board they serve on is outside of community expectations. Despite this, few feel the need to make any significant changes. PwC asked these directors how companies are responding to recent developments in governance across Australia.

Just under 40% said they had already taken some form of action to change the state of affairs. This group is waiting for these changes to play out and have some tangible impact. Changes usually involve greater involvement between the board and senior management. Meanwhile, more than 25% of respondents told PwC that their company does not feel the need to adapt.

Others recognize the need for change. Despite the fact that CEOs in Australia are showing momentum and skillfully manage market changes, it is essential that board members are on the same page to ensure that governance standards are upheld. Less than 20% of directors said that a change in governance brought about a change in their company.

These respondents recognized the need to make more effective changes. The remaining 15 said they had taken no action yet, but not for lack of intention. This group is “in the early stages” of preparing to make significant management changes.

When asked about the exact nature of the changes being made, most revealed that the most appropriate solution was to invest more time and energy in developing a strong and coherent company culture. The second most popular policy was to bring changes to pay structures to make them more appropriate.

Others tend to focus more on communication between the board and management, indicating that they are trying to bring more clarity to the expectations that are set for management. From this comes the practice of ensuring that the company’s goals are aligned from top to bottom.

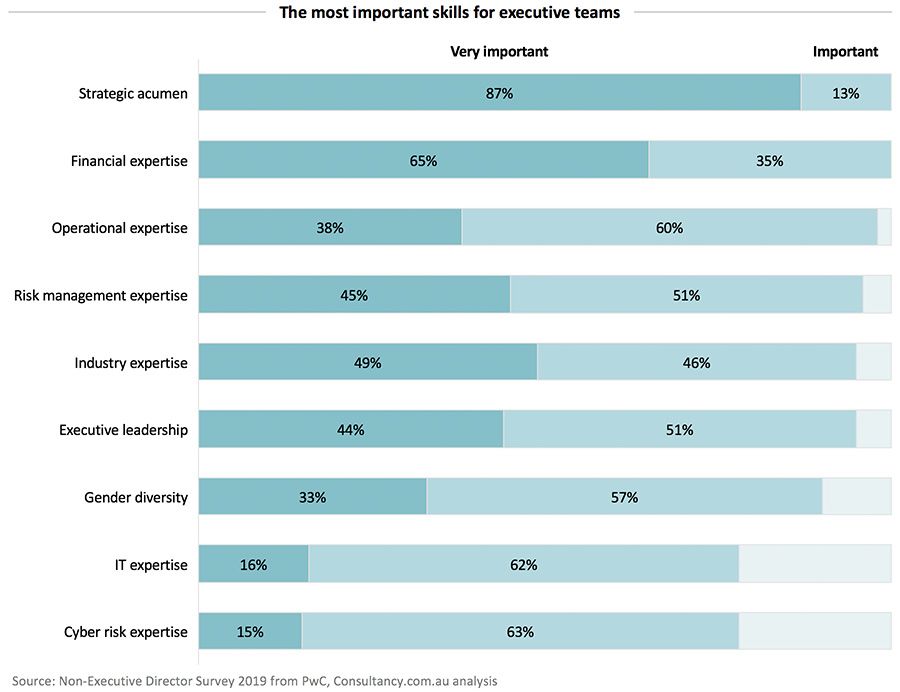

Some even engaged in complex structural changes and decided to change the composition of the board. These structural changes are primarily aimed at making the board’s portfolio of skills more relevant to current market demands. Strategic foresight, risk management expertise and gender diversity are some of the potential goals when it comes to the composition of new records.

However, these requirements vary from company to company. A number of other priorities were cited in response to the PwC survey, including financial expertise, industry expertise, digital expertise and cyber risk expertise, all of which are remarkably relevant to the current business environment in Australia and around the world.

While making such far-reaching changes in board composition is a challenge on one hand, many expressed confidence in the board’s ability to attract talented new directors. Most are confident, although some have said that the risk associated with being a director may deter talented applicants.

[ad_2]