[ad_1]

Sydney and Melbourne have maintained their position in the top 20 of the Global Financial Centers Index, a report on the competitiveness of financial markets published by British research consultancy Z/Yen Partners.

Developed in collaboration with the China Development Institute since 2016, the index is updated every September and March. Z/Yen Partners’ Global Financial Center Index (GFCI) assesses the competitiveness of 100 financial centers around the world, from London, New York and Hong Kong to Panama, Istanbul and Manila – using 137 quantitative measures compiled from leading data sources and more. 30,000 financial center surveys.

With respect to the metrics used, which draw from sources such as the World Bank, the OECD and the UN, the instrumental factors are divided into five broad categories of business environment, human capital, infrastructure, financial sector development and reputation. , with additional input drawn from a number of global consulting firms including AT Kearney, Capgemini, Mercer, The Boston Consulting Group, PwC and KPMG.

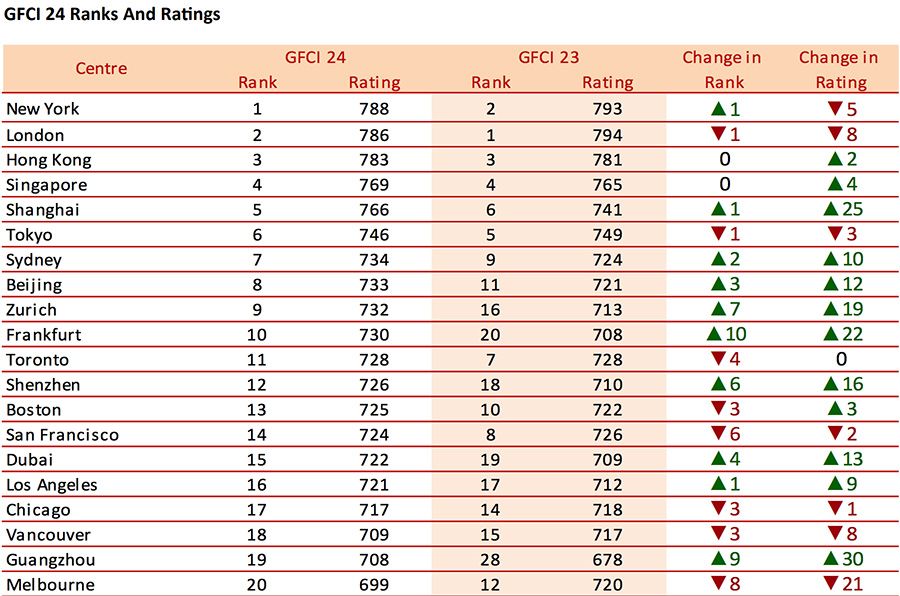

New York topped the rankings, overtaking London after the UK capital struggled to negotiate with Brussels. The other four spots were dominated by Asian financial centers Hong Kong, Singapore, Shanghai and Tokyo, suggesting that the Asian century is well underway. Sydney was ranked 7th overall, followed by Beijing and Zurich making up the rest of the top 10.

Since the GFCI began a decade and a half ago, Sydney has performed well, consistently maintaining a score above 600. This year, Sydney scored 734, a 10-point improvement over the previous analysis and moving up two places in the index. As a result, Sydney edged out Toronto and San Francisco, who both dropped out of the top 10.

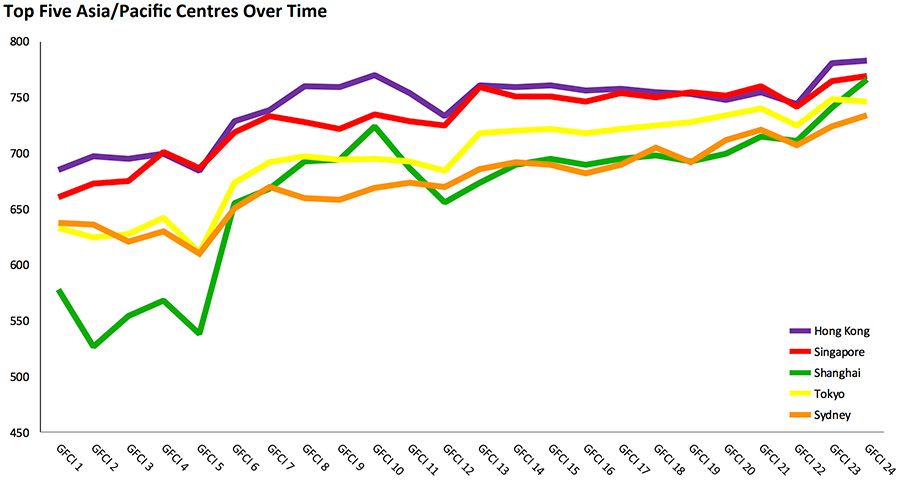

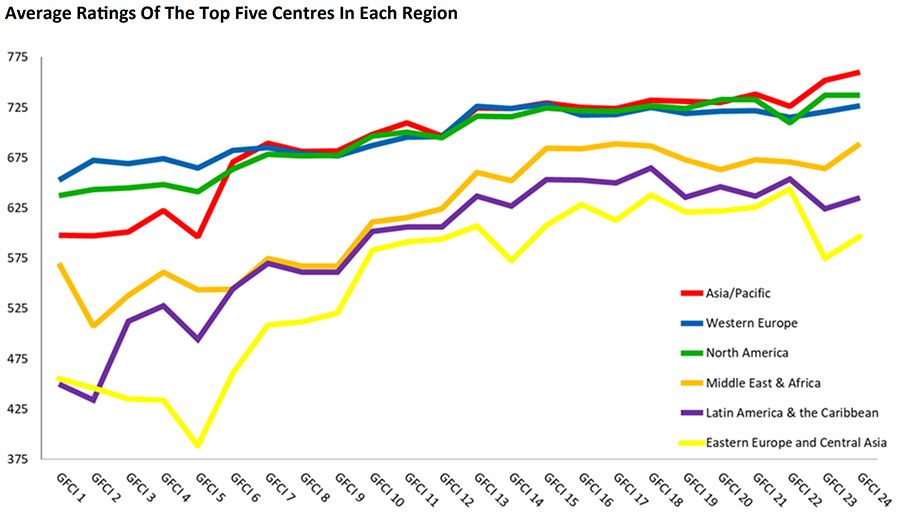

The report touches on the turn towards Asia from the dominance of Western financial centers of the past years. “The center in the Asia-Pacific region generally increased in ranking, continuing a trend that has been evident for several years,” the report said.

Sydney’s proximity to its four northern neighbors – both geographically and metaphorically on the index – may have been influential in its gaining a foothold as one of the world’s most important financial centres.

Melbourne maintained its place in the top 20, but only marginally, falling from 12th to 20th over the past six months. Melbourne lost 21 rating points overall and was overshadowed by newcomers such as Shenzhen, Guangzhou, Dubai and Frankfurt, among others and better ones. Wellington also appeared in the index, ranking at a stable 45th place.

Sydney scored best in the ‘financial sector development’ competitiveness area, which includes factors such as the depth and breadth of industry clusters and the availability of capital and market liquidity. Infrastructure such as the built environment, ICT infrastructure and transport infrastructure were also high on Sydney’s list.

In addition to the business environment and economic performance, the consulting firm also takes into account many other criteria that underlie each center, including quality of life, cultural diversity, sustainable development, level of innovation and brand/attractiveness of the city.

The report’s authors note that in the past decade and a half—since the GFCI began—there has been a significant shift from Western financial centers to Asian ones.

“The long-term trend since our first published issue in 2007 has been the steady and sustained rise of Asian hubs, while the press and pundits focus on short headlines about London and New York,” says Z/Yen’ CEO Michael Mainelli. “When 60% of the index moves from Western centers to Asian centers in ten years, it’s time to think.”

“Financial centers can, and do, control a great deal of their destiny. GFCI 24 shows a wide range of strategy, competition, specialization and, I would say, style in which they do it,” concludes Mainelli.

[ad_2]