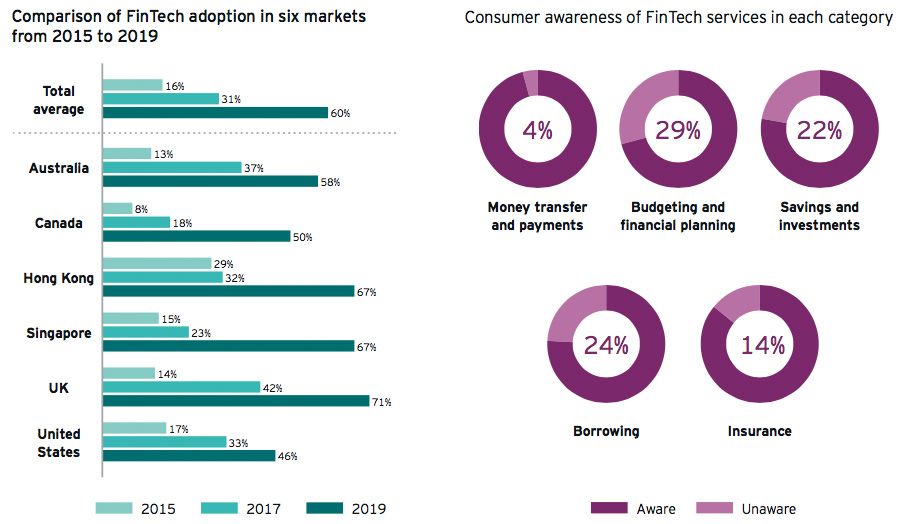

Australia is among the top six global markets experiencing significant growth in FinTech adoption, with nearly 60% of consumers in the country now using financial technology services—a sharp rise from just 37% two years ago. This surge places Australia at the forefront of FinTech adoption, contributing to a broader trend seen across key markets worldwide.

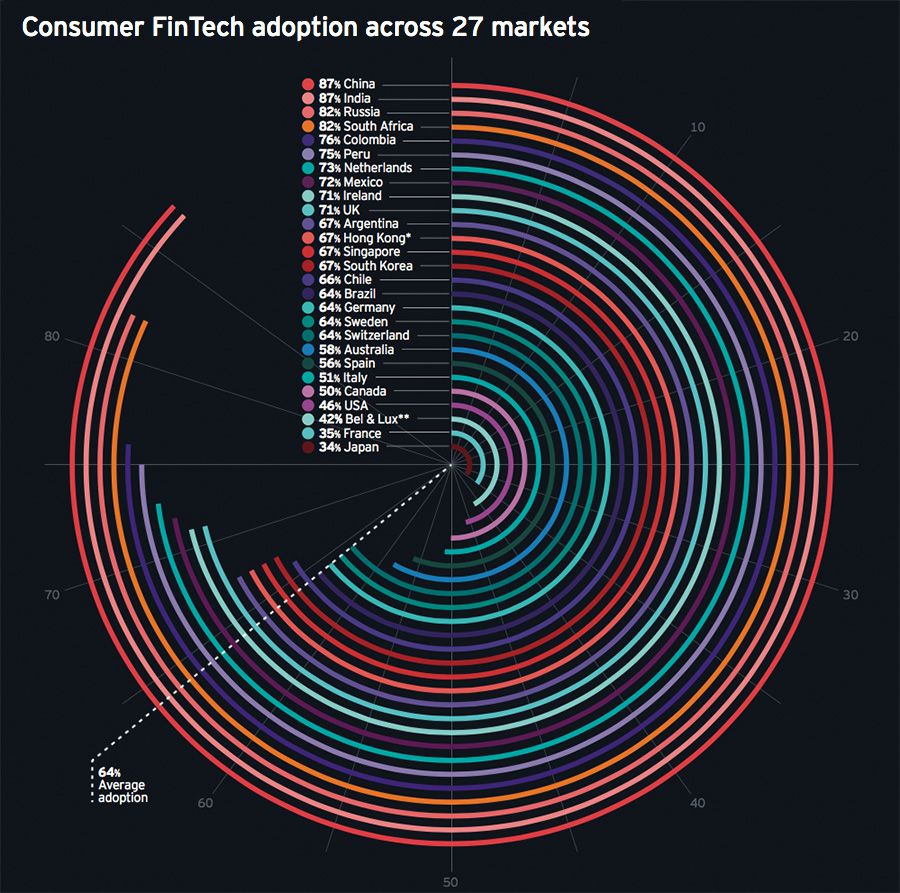

The Global FinTech Adoption Index, compiled by EY, reveals these figures based on a survey of 27,000 consumers in 27 countries. Other leading nations showing similar increases include Canada, Hong Kong, Singapore, the United Kingdom, and the United States. These markets collectively have seen FinTech adoption double over the last few years, from 31% in 2017 to a striking 60% this year.

How Australia’s FinTech Adoption Compares

While Australia’s FinTech adoption rate stands at 58%, just below the global average of 64%, the growth rate is significant. The country has witnessed a 4-fold increase in adoption since 2015, when the figure was just 13%. This growth can be attributed to a combination of consumer openness and increasing FinTech innovation across sectors like banking, insurance, and financial services.

Although investment in Australia’s FinTech sector has slowed recently—dropping by 50% compared to last year—Australian firms continue to perform strongly on the global stage. AfterPay Touch and Airwallex were both named in the Top 50 FinTech Companies worldwide by investment firm H2 Ventures, further solidifying Australia’s reputation as a growing FinTech hub.

A Growing Global Trend

Globally, FinTech adoption has grown rapidly over the past four years, with the global average now sitting at 64%—almost doubling from 31% in 2017. In Australia, this increase in adoption reflects the expanding variety of FinTech services available to consumers, spanning multiple areas such as:

- Money Transfers and Payments

- Budgeting and Financial Planning

- Savings and Investments

- Loans and Insurance

EY categorizes these services into five distinct groups or “buckets,” with the adoption rate based on the use of two or more of these services. Australia’s 58% adoption rate places it in line with similar markets, showing strong consumer awareness and usage across multiple financial sectors.

Why is FinTech Adoption Growing?

In Australia, the shift toward digital financial solutions is not just about access to technology—it’s about consumer awareness and a more open mindset. As of today, Australian consumers are increasingly aware of the potential of FinTech, with awareness levels in some services reaching nearly 99.5% for money transfers and payments.

This growing awareness, combined with targeted marketing and innovation from FinTech companies, has led to a sharp increase in adoption. However, despite the success in adoption, the low investment figures in Australia’s FinTech space pose a challenge, as these services need ongoing support and development to maintain growth.

Australia’s FinTech Outlook

The international outlook for Australia’s FinTech sector looks promising. As markets across Asia and the Asia-Pacific region continue to grow, Australia stands to benefit from this expansion. Countries like China and India are leading the global index with an 87% FinTech adoption rate, and this momentum is expected to ripple through the Asia-Pacific network, potentially accelerating Australia’s FinTech growth.

With more than half of the top FinTech fundraisers in the six major markets (including Australia) planning to use raised funds for international expansion, Australian firms are increasingly setting their sights on global opportunities. As the FinTech landscape matures and globalizes, Australia’s FinTech ecosystem is poised for further expansion and innovation.